What's the average time to bring a drug to market in 2022?

COVID vaccines and antivirals sped through clinical trials and regulatory approvals in record time. But these records are even more impressive when you understand just how long drug development typically takes.

In this article, we’ll provide some facts about the average drug development timeline, how much drug development costs, and what sponsors are doing to streamline the process.

What’s the average time to bring a drug to market?

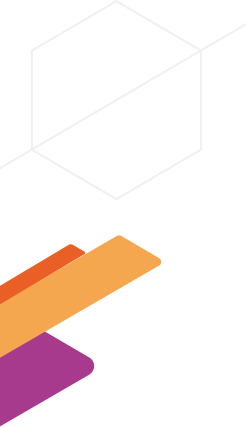

According to industry group PhRMA, it takes 10-15 years on average to develop one new medicine from initial discovery through regulatory approval.

Other sources corroborate this number. Biotechnology Innovation Organization (BIO), another industry group, analyzed 9,704 clinical development programs over the course of a decade from January 2011 to November 2020. They found that, on average, it took 10.5 years for a drug to get from Phase I to regulatory approval.

Looking at individual stages of the process, the averages were 2.3 years for Phase I, 3.6 years for Phase II, 3.3 years for Phase III, and 1.3 years between Phase III and regulatory approval.

According to BIO, a drug’s disease area impacts how long it takes to get to market. While 10.5 years was the average for drugs across all disease areas, averages for specific areas ranged from 9.2 to 12.2 years. At the lower end were drugs focused on allergic, metabolic, and infectious diseases. Meanwhile, drugs focused on neurological, cardiovascular, and urologic diseases had the longest development timelines.

Related white paper: Learn how leading pharmaceutical and biotech firms are accelerating time to market

Is drug development getting faster?

No. In fact, clinical research takes longer than it used to.

The Tufts Center for the Study of Drug Development (CSDD) looked into this question in 2018, and found that FDA-approved drugs and biologics spent 89.8 months on average in clinical trials between 2014 and 2018, compared to 83.1 months on average between 2008 and 2013.

While no research has been completed yet on the average time to bring a drug to market in 2022 specifically, it’s reasonable to assume that the number is at least 10-15 years inclusive of initial stages, and perhaps slightly longer due to the trend toward extended research timelines.

How much does it cost to bring a drug to market?

Drug development is a massively expensive undertaking. While costs will vary widely depending on many factors including type of drug and disease area, estimates for the average cost of creating a new drug range as high as $2.6 billion USD.

One paper published in JAMA in March 2020 puts the estimate much lower at $985 million USD, though that research relied on publicly available data which was mostly from smaller firms.

No matter which way you slice it, the numbers are extremely high. One reason is that estimates of drug development costs include expenditures on failed trials, and for every drug that makes it to market, there are many more that don’t.

What percentage of drugs are eventually approved?

Drugs go through a rigorous process to ensure they’re effective and not harmful. As a result, only a small percentage of drugs that start the research process are actually approved for use.

This is a major reason it costs so much and takes so long to bring a drug to market. According to the BIO report, the average likelihood of approval for all drugs in Phase I development is only 7.9%.

That means that more than 9 out of every 10 drugs in Phase I research are not approved.

What’s being done to speed up drug development?

An average time-to-market of more than 10 years is a no-win situation. For sponsors, it represents a lot of risk spread out over a long period. U.S. patents on new drugs only last 20 years; that means half of the patent time on average is spent in the research and regulatory approval phases. This delayed return on investment would be unacceptable in nearly every other industry.

More importantly, it means that fewer patients can access the medicines they need when they need them.

The rapid development and approval of COVID vaccines and antivirals demonstrated that, with enough funding and political willpower, it’s possible to accelerate drug development timelines.

While it’s unlikely that future drugs will be created and approved in the span of less than a year, as the first COVID vaccines were, there is hope that this experience can help decrease regulatory inertia for other drug programs. Regulators around the world are already introducing and improving programs that aim to speed up the approval process.

Meanwhile, sponsors are turning to emerging technology to find ways to optimize clinical research. For example, AI is being used to accelerate drug discovery, and 3D bioprinting shows promise for speeding up the development of biologics.

In addition, sponsors are using big data to their advantage by optimizing their clinical supply chains. As regulatory approval accelerates, the risk of the supply chain becoming a bottleneck increases. Sponsors can remove bottlenecks in the manufacturing and research supply chains using advanced simulations and collaborative data-sharing solutions.

These solutions help accelerate individual trials and enable sponsors to respond proactively to changes in the wider industry landscape. In addition, by reducing the costs and supply needs of individual trials, they allow sponsors to run more trials simultaneously.

Learn more in this whitepaper:

End-to-end clinical supply chain optimization helps bring drugs to market faster

About the Author

Max is passionate about problem solving and change management. He leads the Solutions Engineering team and has been at N-SIDE for over 7 years of experience. He helps pharmaceutical organizations realize the value of optimization and transform their forecasting & planning processes.

Maxime Derep

Article

Forecasting and optimization in clinical trials

Learn about the latest advances in clinical trial forecasting and optimization. Understand how technology can help you overcome challenges you face in your clinical trial supply management.

Read now

Whitepaper

Accelerating time to market

Hear from Biotech industry experts how challenges in clinical trial supply and manufacturing can be overcome with innovative software solutions.

Download it now!

Article

Enable faster clinical trial timelines through an optimal supply chain

Waste reduction has been identified has one of the causes of slower clinical trials timelines. However, whereas waste reduction is often coupled with cost reduction, wasted drugs, when allocated efficiently, can also be enablers of faster timelines.

Read now